Consumer Assist: Seek out a supplier that offers focused help, together with usage of professional specialists who will response questions on compliance and IRS regulations.

Greater Costs: SDIRAs generally feature increased administrative costs as compared to other IRAs, as certain facets of the executive approach cannot be automatic.

Entrust can support you in acquiring alternative investments together with your retirement resources, and administer the obtaining and promoting of assets that are generally unavailable by way of banks and brokerage firms.

Research: It truly is termed "self-directed" for a motive. Using an SDIRA, you might be fully to blame for completely investigating and vetting investments.

Even though there are numerous Gains associated with an SDIRA, it’s not devoid of its individual drawbacks. A number of the widespread reasons why traders don’t opt for SDIRAs include:

Simplicity of use and Know-how: A consumer-helpful platform with on the web applications to trace your investments, post files, and take care of your account is vital.

Incorporating funds directly to your account. Take into account that contributions are matter to annual IRA contribution limitations established via the IRS.

Have the freedom to take a position in Virtually any kind of asset which has a threat profile that fits your investment method; including assets that have the potential for a better fee of return.

Selection of Investment Possibilities: Ensure the company lets the categories of alternative investments you’re enthusiastic about, like real estate, precious metals, or private fairness.

SDIRAs are often used by arms-on buyers who will be ready to tackle the hazards Precious metals depository services and responsibilities of choosing and vetting their investments. Self directed IRA accounts can be great for traders which have specialized knowledge in a niche marketplace which they wish to spend money on.

Opening an SDIRA can provide you with usage of investments Usually unavailable by way of a bank or brokerage firm. Here’s how to begin:

Put just, for those who’re searching for a tax successful way to create a portfolio that’s a lot more tailor-made to the passions and expertise, an SDIRA could possibly be the answer.

Subsequently, they tend not to promote self-directed IRAs, which provide the flexibility to invest inside a broader number of assets.

An SDIRA custodian differs as they have the suitable personnel, abilities, and capability to keep up custody from the alternative investments. you could check here Step one in opening a self-directed IRA is to locate a supplier that is certainly specialised in administering accounts for alternative investments.

In advance of opening an SDIRA, it’s important to weigh the opportunity positives and negatives dependant on your particular economic objectives and chance tolerance.

Complexity and Obligation: With an SDIRA, you have much more Manage above your investments, but In addition, you bear additional obligation.

Relocating money from one particular form of account to a different form of account, for example relocating money from a 401(k) to a conventional IRA.

This includes knowledge IRS polices, running investments, and staying away from prohibited transactions that can disqualify your IRA. A lack of knowledge could bring about expensive problems.

Sometimes, the expenses linked to SDIRAs may be higher and much more complicated than with an everyday IRA. It's because from the greater complexity affiliated with administering the account.

Marcus Jordan Then & Now!

Marcus Jordan Then & Now! Samantha Fox Then & Now!

Samantha Fox Then & Now! Tonya Harding Then & Now!

Tonya Harding Then & Now! Katey Sagal Then & Now!

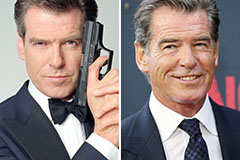

Katey Sagal Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now!